December 12, 2019

The Internal Revenue Service (IRS) recently announced the annual inflation adjustments for more than 60 tax provisions for the year 2020, including key estate, gift, and generation-skipping transfer tax (“GST”) exclusion amounts.

To assist you in your planning, we are happy to report these federal adjustments as well as to report the adjustments that will be made in 2020 in Connecticut, Massachusetts and New York.

FEDERAL LAW

For calendar year 2020, the federal applicable exclusion amount will increase from $11.4 million to $11.58 million. This change increases each person’s (i) applicable exclusion amount available at death, (ii) lifetime gift applicable exclusion amount, and (iii) GST applicable exclusion amount.

PLANNING IMPACT: A married couple with proper planning may be able to transfer to their beneficiaries a combined total of $23.16 million in 2020 free of estate, gift and GST taxes.

The federal estate, gift and GST rates remain at 40%, and the per-donee gift tax annual exclusion will also remain at $15,000. The federal gift tax annual exclusion amount for gifts to a non-citizen spouse will increase to $157,000 in 2020. Please note that gifts between spouses remain unlimited if the recipient spouse is a United States citizen.

PLANNING IMPACT: Annual exclusion gifts are still a great way to transfer wealth to one’s beneficiaries without eroding one’s lifetime gift exclusion amount. If annual gifts to any one person don’t exceed the annual exclusion amount, no gift tax return is required. However, please remember that a married couple can only utilize “gift splitting” (i.e., applying a spouse’s annual exclusion amount against a gift by the other spouse to a third party) by filing gift tax returns.

CONNECTICUT

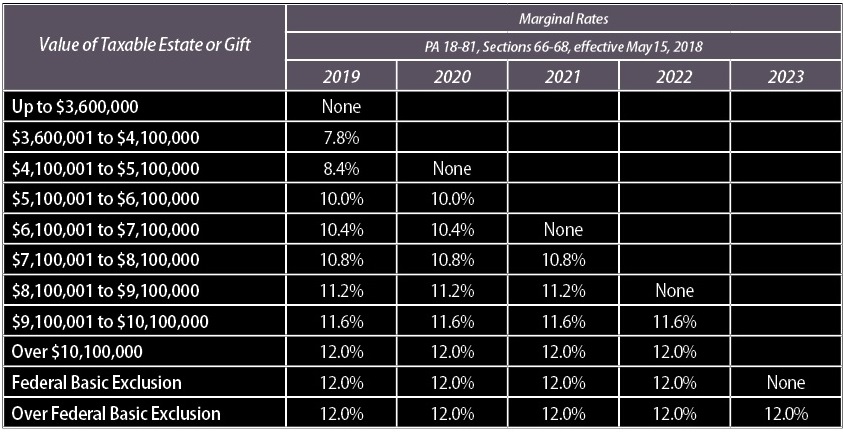

In 2020, the Connecticut estate and gift tax exemptions will increase from $3.6 million to $5.1 million. The Connecticut estate tax rates continue to range from 7.8% to 12%, as illustrated in the following table:

PLANNING IMPACT: A married couple domiciled in Connecticut with proper planning may be able to transfer to their beneficiaries a combined total of $10.2 million in 2020, free of Connecticut estate and gift taxes.

MASSACHUSETTS

The Massachusetts estate tax exemption is, and will remain at, $1 million in 2020. Future changes to the Federal estate tax law have no impact on the Massachusetts estate tax. The Massachusetts estate tax rates range from 5.6% to 16%.

Massachusetts has no gift tax, although taxable gifts are included in the estate tax calculation and therefore may affect the estate tax that is imposed.

PLANNING IMPACT: Even though Federal taxable gifts are added back into the Massachusetts estate tax computation base, Massachusetts domiciliaries may still be better off making lifetime gifts to reduce their overall transfer tax burden.

NEW YORK

The New York estate tax basic exclusion amount for a person dying during calendar year 2020 will increase from $5.74 million to $5.85 million. While New York does not impose a current gift tax, the New York gross estate of a deceased resident is increased by the amount of any taxable gift made within three years of death. New York’s three-year gift add-back expired for individuals dying on or after Jan. 1, 2019, but was extended until Dec. 31, 2025 as part of the Budget (NY Tax Law §954(a)(3)). The final legislation excepts from the add-back gifts made between Jan. 1, 2019 and Jan. 15, 2019, the period prior to the Budget’s release.

The New York estate tax is a “cliff tax.” If the value of the taxable estate is more than 105% of $5.85 million, the exemption is effectively eliminated in the tax computation.

PLANNING IMPACT: For New York domiciliaries, taxable gifts (i.e., gifts in excess of the federal annual gift tax exclusion) will likely reduce their overall transfer tax burden.

Please contact your Murtha Cullina estate planning attorney to discuss the impact of these developments on your estate plan in more detail.

![]() te_key_2020_wealth_transfer_tax_numbers.pdf

te_key_2020_wealth_transfer_tax_numbers.pdf